Buying a piece of agricultural land in Karnataka can be a smart investment—whether for farming, farmhouse development, weekend retreats, or simply for land appreciation. However, farmland purchases come with a different set of legal requirements compared to residential plots or apartments.

Without due diligence, a buyer can easily fall into legal complications, title disputes, or end up with restricted-use land. For this reason, before purchasing farmland in Karnataka, a comprehensive legal checklist is necessary.

This guide gives you a complete overview of the legal and procedural steps you must take to ensure your farmland purchase is safe, compliant, and valuable.

Can Anyone Buy Agricultural Land in Karnataka?

Unlike some Indian states that restrict farmland ownership to farmers, Karnataka allows both farmers and non-farmers to buy agricultural land—after amendments made in 2020.

Key Eligibility Criteria (Post-2020 Amendment):

- No income ceiling limit (earlier ₹25 lakh/year)

- Individuals or companies can purchase

- No need to prove agricultural background

However, the land must be used only for agricultural purposes unless legally converted.

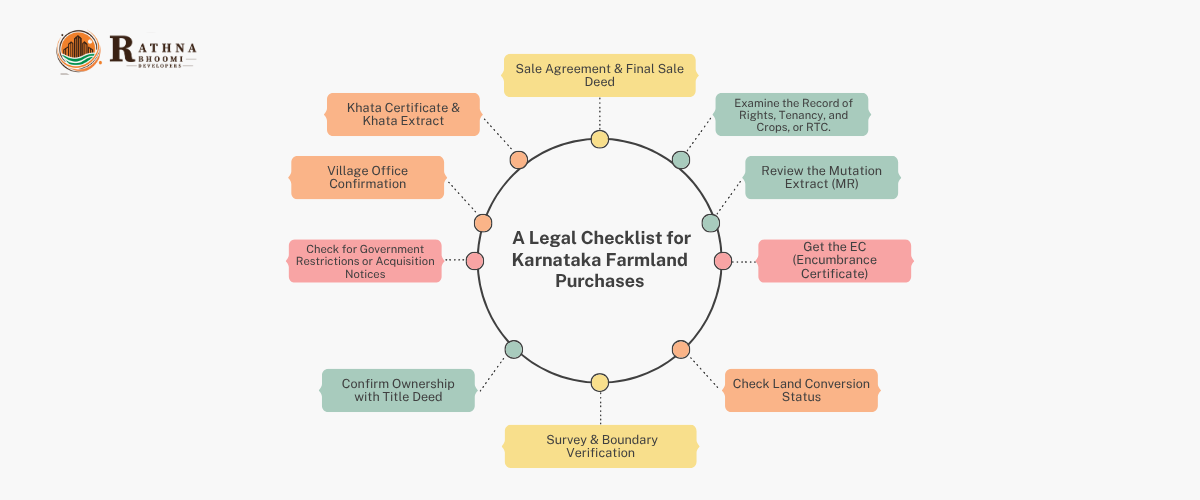

A Legal Checklist for Karnataka Farmland Purchases

Here’s a complete step-by-step legal checklist to follow when buying agricultural land:

1. Examine the Record of Rights, Tenancy, and Crops, or RTC.

- Known as Pahani, this document reflects:

- Ownership details

- Type of land

- Crop patterns

- Land usage history

- Ownership details

Avoid land listed as government property, forest land, or under tenancy disputes.

2. Review the Mutation Extract (MR)

- This confirms the latest transfer of ownership.

- Ensures the land has been legally passed on or sold.

Check for any inheritance gaps or pending mutation requests.

3. Get the EC (Encumbrance Certificate)

- Shows if the land has any:

- Loans

- Mortgages

- Legal dues

- Court cases

- Loans

Obtain EC (Forms 15 and 16) for a minimum of 30 years..

4. Check Land Conversion Status

Agricultural land cannot be used for residential or commercial purposes unless converted by the Deputy Commissioner under Section 95 of the Karnataka Land Revenue Act.

- If you’re planning to build a farmhouse or layout, get:

- DC Conversion Certificate

- Zoning approval from BDA/BBMP/local body

- DC Conversion Certificate

5. Survey & Boundary Verification

Before finalizing:

- Get the land surveyed by a licensed surveyor.

- Verify the borders against the village’s records and map..

- Physically inspect to avoid future encroachment disputes.

Tip: Request a Survey Sketch from the Land Records Department.

6. Confirm Ownership with Title Deed

- Request the original Title Deed and get it legally vetted.

- Make sure it’s clear, unencumbered, and allows sale.

Red Flags:

- Duplicate title deeds

- Undivided share of ancestral land

- Ongoing family disputes

7. Check for Government Restrictions or Acquisition Notices

Certain areas near highways, railway zones, or industrial corridors may be under:

- Government acquisition

- Environmental regulation

- Land reforms

For any notices, check with the Revenue Department or Tehsildar.

8. Village Office Confirmation

Visit the local gram panchayat or village accountant office to:

- Cross-check land ownership

- Confirm usage

- Check pending taxes or disputes

9. Khata Certificate & Khata Extract

Khata is an account of a person who owns a property.

- Khata Certificate: For establishing ownership

- For property information from the municipal records, use the Khata extract.

Note: While Khata isn’t mandatory for farmland like it is for urban properties, it is useful during future conversion or resale.

10. Sale Agreement & Final Sale Deed

Once due diligence is complete:

- Draft a registered Sale Agreement clearly stating:

- Advance paid

- Terms of sale

- Timeline

- Penalties

- Advance paid

- On final payment, execute a Sale Deed on stamp paper and register at the Sub-Registrar Office.

Don’t forget to pay:

- Stamp duty (usually 5%–6%)

- Registration charges (around 1%)

11. Update Records Post-Sale

After registration, apply for:

- Mutation of Records in your name

- Updated RTC (Pahani) with your ownership details

This ensures you’re the legally recorded owner in government records.

Common Pitfalls to Avoid

- Buying land from someone with power of attorney but no ownership

- Assuming land can be used for housing without conversion

- Ignoring zoning regulations (green belt, forest buffer, etc.)

- Not verifying pending litigation or family claims

Always consult a real estate lawyer before closing the deal.

Bonus Tip: Prefer DTCP-Approved Farm Layouts

If you’re buying land from a developer for farming or farmhouses:

- Prefer DTCP-approved farm layouts

- Ensure proper documentation for roads, water, drainage, and electricity

- Verify project registration (RERA, if applicable)

Developers such as Rathna Bhoomi Developers guarantee fully transparent, DTCP-approved farmland projects close to Bengaluru that are legally sound.

Need Help Buying Farmland in Karnataka?

Whether you’re a first-time buyer or an experienced investor, navigating farmland legality can be tricky. Rathna Bhoomi Developers offers verified farmland projects with:

- Clear titles

- Government approvals

- Gated amenities

- Prime locations near Bengaluru

Final Thoughts

Buying farmland in Karnataka can be one of the most rewarding long-term investments—if done right. With increasing demand for sustainable living and nature-connected lifestyles, farmland values are only going up.

Use this legal checklist for land buyers as your go-to guide, and always partner with a trustworthy developer to avoid future complications.

Are you prepared to invest in DTCP-approved, lawful acreage close to Bengaluru?

Contact Rathna Bhoomi Developers

www.rathnabhoomidevelopers.com

contact@rathnabhoomidevelopers.com

+91-538752960